NVIDIA Stock Split: What Investors Need to Know

NVIDIA, the American multinational technology company best known for its powerful GPUs (graphics processing units), has been a key player in the semiconductor industry for years. Its impressive growth in the fields of gaming, artificial intelligence (AI), and data centers has captured the attention of investors and technology enthusiasts alike. As one of the most influential tech companies in the world, NVIDIA’s stock is frequently in the spotlight. One of the significant events in the company’s stock history was its stock split, an action that garnered a lot of attention and raised questions among investors.

In this article, we’ll explore what a stock split is, why companies like NVIDIA choose to do it, and how the most recent stock split impacted the company and its shareholders.

What Is a Stock Split?

Before diving into NVIDIA’s specific stock split, it’s essential to understand what a stock split entails. A stock split is a corporate action in which a company divides its existing shares into multiple shares, without changing the overall value of the company. This is done to increase the number of shares available to investors while lowering the price per share, making the stock more accessible.

For instance, in a 4-for-1 stock split, a shareholder who owns one share before the split would now own four shares after the split. The total value of the shares remains the same, but each individual share has a lower price. Stock splits are often seen as a sign of a company’s growth, and they can encourage more investors to buy in, which can benefit both the company and its shareholders.

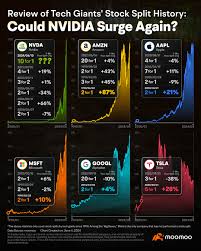

NVIDIA’s Stock Split History

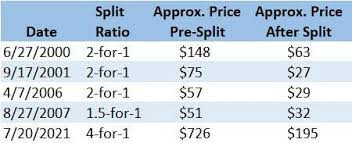

NVIDIA has undergone several stock splits over the years, reflecting the company’s continuous growth. NVIDIA’s stock has split four times in its history, with the most recent stock split occurring in July 2021. Here’s a quick overview of NVIDIA’s stock split history:

- June 27, 2000 – 2-for-1 stock split.

- September 17, 2001 – 2-for-1 stock split.

- April 7, 2006 – 2-for-1 stock split.

- July 20, 2021 – 4-for-1 stock split.

The most recent 4-for-1 stock split in July 2021 was especially noteworthy. NVIDIA’s stock price had seen significant growth in the years leading up to the split, driven by increasing demand for its GPUs in gaming, AI, and cryptocurrency mining. As a result, the stock price had risen substantially, making it less affordable for some retail investors.

The 2021 Stock Split

On May 21, 2021, NVIDIA announced that its Board of Directors had approved a 4-for-1 stock split, subject to shareholder approval. Following the shareholder meeting on June 3, the split was finalized, and the new shares began trading on a split-adjusted basis on July 20, 2021. Each shareholder received four shares for every one share they owned, while the stock price was reduced accordingly.

At the time of the announcement, NVIDIA’s stock was trading above $600 per share. Following the split, the stock price was reduced to around $150 per share, making it more affordable for retail investors. However, the overall market capitalization of the company remained unchanged. This action made NVIDIA’s stock more accessible and increased liquidity in the market.

Why Do Companies Like NVIDIA Choose to Split Their Stock?

There are several reasons why companies choose to split their stock, and NVIDIA’s decision was no different. Some of the primary reasons for a stock split include:

- Improved Accessibility for Retail Investors: As a stock’s price rises, it can become less affordable for small retail investors to buy individual shares. By splitting the stock and reducing its price, the company makes it more accessible to a broader range of investors. In NVIDIA’s case, the lower post-split share price allowed more retail investors to participate in the company’s growth.

- Increased Liquidity: Stock splits can increase liquidity in the market by making shares more affordable and encouraging more trading activity. A greater number of shares with a lower price can make it easier for investors to buy and sell, which can lead to improved liquidity.

- Positive Sentiment: Stock splits are often seen as a positive signal. Companies typically only split their stock when they have experienced significant growth and expect continued success. This can lead to increased confidence among investors and further drive stock performance.

- Attracting New Investors: A lower share price may attract new investors who were previously priced out of the market. Additionally, some investors may view a stock split as a sign that the company is financially healthy and growing, leading to increased interest in the stock.

Impact of the Stock Split on NVIDIA’s Stock Performance

NVIDIA’s stock split in 2021 was well-received by investors and the market as a whole. Following the split, the company continued to experience strong growth, driven by its expanding presence in various industries, including gaming, AI, data centers, and autonomous vehicles.

Although a stock split doesn’t directly impact a company’s fundamentals, it can have psychological effects on investors. Many investors view a stock split as a sign that the company expects further growth, which can lead to increased demand for the stock. After the split, NVIDIA’s stock price continued to climb, reaching new highs in the months following the split.

It’s important to note, however, that while stock splits can make shares more affordable and accessible, they don’t change the underlying value of the company. Investors should focus on a company’s fundamentals, growth prospects, and overall performance rather than the effects of a stock split when making investment decisions.

Conclusion

NVIDIA’s stock split in 2021 was a strategic move that aligned with the company’s growth trajectory and made its stock more accessible to a broader range of investors. By lowering the price per share, the split allowed more retail investors to participate in the company’s success, increased market liquidity, and signaled confidence in its future performance.

For long-term investors, NVIDIA remains a compelling investment opportunity, with its leadership in the GPU market and its innovative advancements in AI, data centers, and gaming. While stock splits may generate excitement and encourage investor participation, it’s always essential to focus on the fundamentals when considering any investment decision.

In the case of NVIDIA, the company’s strong financials, technological innovation, and growing market opportunities make it a solid choice for investors looking for exposure to the semiconductor industry. The stock split was just one more step in the company’s impressive growth story.